On average half of all New Zealanders change their address every five years(Statistics NZ). As families grow, priorities change. School zones or that extra bedroom become more important.

- Before selling your home make sure you get your next home loan approval in writing. And ensure that you understand any deadlines and conditions.

- Organise any deposit you might require for any auctions you might attend, especially important if you are buying before selling.

There are various methods we facilitate the transition from one house to another:

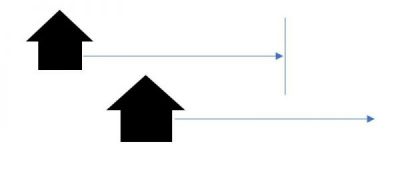

Open ended bridging

This is where we organise funding which allows you to buy the new home first and then gives you time to sell the old one. This is the cleanest approval allowing you to sell and buy without too many conditions.

Approval subject to sale

Safest: This is where we get you an approval that states you can borrow a certain amount only after you have sold your current home. This will mean that you have to sell up first and possibly get temporary accommodation while waiting to settle on another property. You could also sell with a condition which allows you to rent back the property from the new owners for the first couple of months.

Using this approval you can also buy a home conditional on selling your home by a set date.

Taking a punt: Another option could be to sell with a late settlement date, say three months later, this may allow you time to find the new house. Or you could buy with a late settlement date, allowing you time to sell. This option carries some fairly big risks.

Closed ended bridging

In the example above if you sold your home with a late settlement date, you could use this type of funding to pay for the new home before you got paid for the old home. This type of bridging finance can be a little easier to get but is only available if you have sold your home unconditionally.